IDBI Home Loan Eligibility, Rates Dec 2022, EMI Calculator, Apply

Table of Content

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. Get all of our latest home-related stories—from mortgage rates to refinance tips—directly to your inbox once a week. Home equity loans and HELOCs are ways of borrowing in which you use your home equity — the difference between your home’s value and what you owe on your mortgage — as collateral.

MyMoneyMantra is India’s largest phygital loan distributor. With trust of 70 lakh customers, we assure hassle free access to the best Home Loans up to 10 crore for housing loan borrowers in India. We use latest technology and AI to serve customers across the length & breadth of our diverse country. Home Loans at floating interest rate offer you ultimate prepayment flexibility. You can prepay early & reduce interest cost as per your cash flows.

Floating Rate Term Deposit

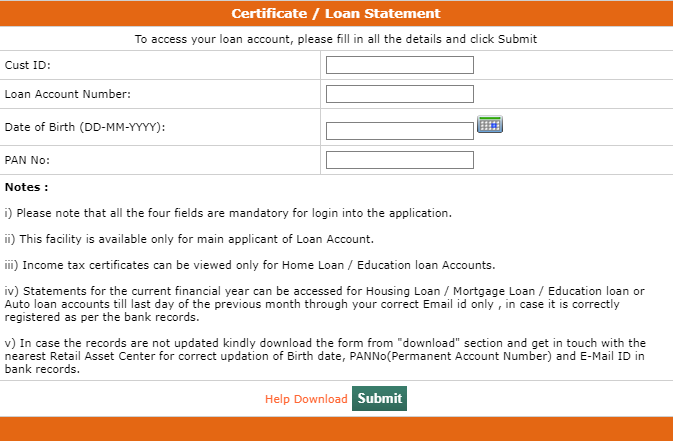

As mentioned above, the interest rate on the home loan varies based on the diverse set of schemes offered by the IDBI Bank. The IDBI Bank accounts for the following factors before determining the interest rate on the home loan. For Home Loan Takeover Facility applicant must have a minimum repayment track record of 6 months. The home loan has been taken with the IDBI BANK where i am using it since from last 6 months also the documentation process was simple and smooth to get the loan. The loan amount released on partial basis and i got the loan within 30 days. CreditMantri will never ask you to make a payment anywhere outside the secure CreditMantri website.

Yes, IDBI Bank helps you to transfer the home loan from another bank without any hassle. After the transfer IDBI Bank will charge a low rate of interest which will help you to save a few lakhs. Salaried Individuals, self-employed professionals, self- employed business people and Non-Resident Indians are eligible to apply for an IDBI Bank home loan. Visit the bank website for a complete list of documents required for IDBI Bank home loan. The below are factors that affect your IDBI home loan interest rate.

Home Loan Rates by Top Banks

To make your repayment options easier, IDBI offers different types of home loans to suit your needs. CreditMantri was created to help you take charge of your credit health and help you make better borrowing decisions. If you are looking for credit, we will make sure you find it, and ensure that it is the best possible match for you. We enable you to obtain your credit score instantly, online, real time. We get your Credit Score online and provide a free Credit Health Analysis of your Equifax report.

A penalty may be imposed on late payment of equated monthly instalments. The customer is expected to be familiar with all such circumstances. Tenure of the personal loan falls within 12 months to 60 months. IDBI Bank offers different repayment methods in addition to the regular repayment facility. CIBIL score is a three digit number which summarizes an applicant’s credit payment history over a specific time period.

IDBI Home Loan Can Be Availed For:

IDBI Bank has a network of 1800 branches and 76 loan-processing centers across India. The process itself is simple and available both online as well as at bank branches and loan centers. – When many people apply for a home loan, preference is given to those at their prime employment age. People who are very close to their retirement age may have to settle down for a higher interest rate as the bank considers them riskier applicants than younger individuals. The processing and administrative fees for the IDBI home loan are as follows. You will also need to pay appropriate taxes on top of the below fees.

Similarly, if a person has a very low CIBIL score, it then denotes that the person has very poor credit behaviour. Thus his or her chances of getting a loan from the bank are less. IDBI Home Loans can have maximum repayment tenure of up to 30 years depending on your eligibility. Existing Home Loan customers of the bank can avail top up facility to fund their personal financial needs. I had taken a Home Loan from IDBI a while back and the process in getting this loan has been fine. The loan amount also had been sufficient, but the interest rate with them has been increasing every month where they had not informed about it.

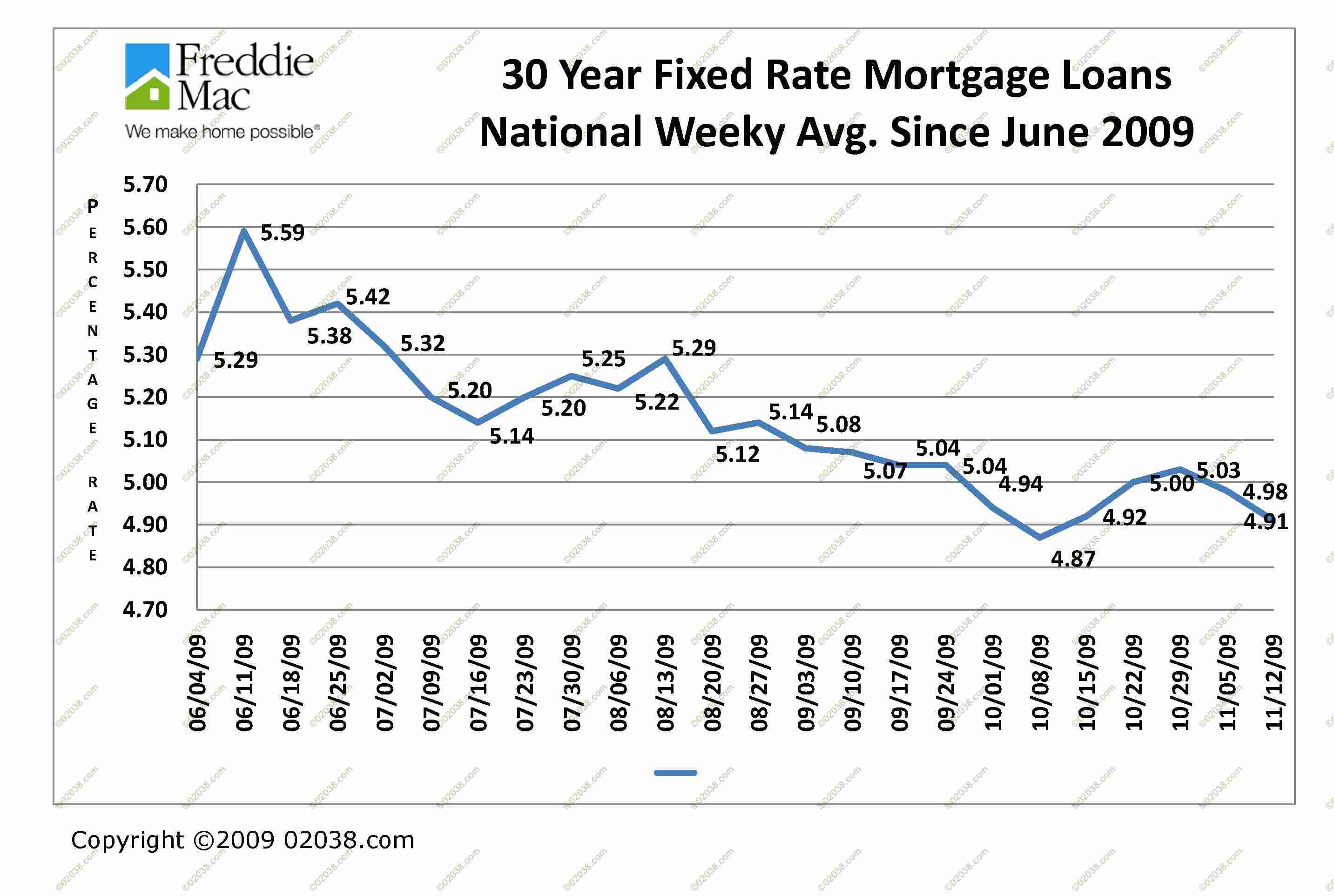

Branch AddressThis month’s hike by the Fed shows the central bank is starting to slow down its rate increases as it approaches a level it expects will be enough to bring inflation down. The 50-basis-point hike comes after four consecutive increases of 75 points. The Federal Reserve has been raising rates this year as part of a bid to address the highest inflation in 40 years. Higher interest rates discourage consumers from borrowing and spending, with the goal of lowering prices by dampening demand. This week, the average interest rate on a 20-year HELOC is 7.81% compared to 7.78% last week and 5.14%, the low over the past year.

I have a home loan with IDBI BANK because the rate of interest is very good. The processing fee was applicable and they have sanctioned the same loan amount what I requested for. What is the maximum loan repayment tenure offered by the bank?

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Each week, you'll get a crash course on the biggest issues to make your next financial decision the right one. Experts worry a recession, which is a possible outcome of the Fed’s rate hikes, will cause more people to borrow against their house to pay the bills.

Prepayment facility is being made available and that too by charging no prepayment charges at all. Below are listed some important points that an applicant has to ensure before applying for a home loan. This makes sure that the entire loan application procedure will be hassle free which otherwise might be tedious. It is actually better to have a co borrower if this person has a good credit behaviour.

Comments

Post a Comment